(3 Other Benefits of Solar You Are Missing Out On, Free Quote, & How to Install a Complete System with $0 Down!)

Here’s the answer you are looking for:

The federal tax credit for installing solar panels in 2022 is 26% of the cost of installing the solar panel system.

This means that for a small solar system of 6 kilowatt capacity that costs around $10,000 to install (enough for eliminating an average electric bill of around $100/month), you get a tax credit of around $2,600 that would be reduced from your federal tax for this year.

For bigger solar systems for homes with more consumption, as the cost of the system would go higher, the tax credit would go higher as well.

For example, for a house that gets an average electric bill of $200/month, you need a 12-kilowatt solar system in order to cover your energy needs, and the cost to get it and install it would be around $18,000.

In this case, the federal solar tax credit would be around $4,680.

And so on.

Note that this is the federal tax credit for installing solar panels that applies wherever your house is located in the United States.

Depending on where you live, you might be eligible for a state solar tax credit or solar tax rebates that might be offered in some states.

So..

Is The Federal Solar Tax Credit Worth it?

Yes, it is worth it to get the solar tax credit as you can benefit from the money you save by spending it on something of your choice, and you better go solar as soon as possible as the solar tax credit will not remain available forever.

The 26% federal tax credit is available for those who install solar panels for their home during 2022, and after the year ends, the tax credit will be reduced down to 22% for the years 2023 & 2024.

And by the end of 2024, the solar federal tax credit will no longer be offered for new installations.

Is The Solar Tax Credit The Only Benefit of Going Solar?

No. The solar tax credit is just a small benefit of going solar. (Keep reading to find out about the 3 main benefits you can’t afford to miss out on)

Don’t Have The Capital to Install Solar Panels? You Don’t Need to!

You can still get all the benefits from installing solar panels for your home even if you don’t have the money to pay for it.

You don’t even have to have a down payment!

And you can do that through the available financing solutions that allow you to install the complete system without paying anything in advance, but rather, pay in installments.

That would of course increase the total cost of the system, but you would still benefit from free energy after paying off the installments, in addition to the tax credit, and the increased home value.

And don’t worry if you don’t know where to find these financing solutions. I will help you!

There’s one of the leading companies in the solar energy field, which is called SunPower, that can give you a free quotation for the solar system for your home, and even guide you on the available financing solutions!

>>> Get Your 100% FREE Solar Quote Here <<<

3 Benefits for Going Solar Other Than The Tax Credit

There are several other benefits that you get from installing solar panels for your house other than the tax credit, and here are the top three:

1. Lower Electricity Bills (Even $0 Bills in Some Cases)

You know that feeling you get every time you receive a utility bill that makes you not wanting to open it. Right?

Depending on how many solar panels you can install for your house, and depending on your average energy consumption, solar panels can help you lower your need to purchase electricity from the utility company or even eliminate it almost entirely.

But typically, the solar panels will provide you with free energy for 20-30 years to come.

With the savings you make on the monthly electric bill after going solar, you can get back the cost of the system through the first 5-10 years, and then enjoy free energy from the system for the rest of the its lifetime.

For example, if you receive a monthly bill of around $100, it means that you pay around $1,200 per year on electricity.

In this case, you need to install a 6-kW solar system in order to cover your consumption, which costs around $10,000.

With the savings you get on your electric bill, you can get your investment back in around eight year and four months.

After that, it’s free energy.

Assuming that the system works for 25 years in total, you get free energy for more than sixteen years!

That’s equivalent to $1,200/year.

Over the lifetime of the system, you save 16 X $1,200 = $19,200!

And if your bill is higher than $100/month, then the savings will be even bigger.

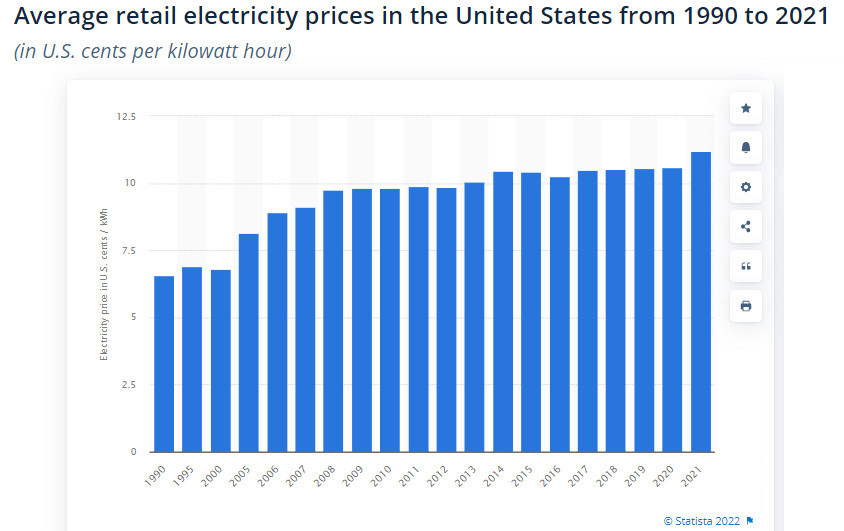

That’s assuming that energy prices remained the same, but they won’t.

Electricity prices increase around %3 per year, which means that your actual savings would be more than the estimate above.

This benefit alone makes it worth installing the system more than the tax credit itself.

Even if you finance the system and pay its cost through installments with interest, you can still pay back the cost of the system in a shorter period than its lifespan, and then enjoy free energy.

2. Protect Your Family Against Energy Prices

Let’s be honest, energy prices will continue to rise year after year, due to the continuous increase in oil and gas prices.

But by going solar, you can pay the cost of the solar panel system that would cover your consumption, and then enjoy free electricity without worrying about the increase in energy prices.

3. Increased Home Value

This is another big benefit of going solar, even bigger than the benefit of the tax credit.

In fact, the increase in home value due to installing solar panels could even be higher than the cost of installation the system!

This alone makes it worth installing solar panels for your home.

According to Zillow, one of the biggest online marketplaces for real estate, solar panels could increase the value of your home by up to 4.1% of its original value or even more, all the way up to 9.9% like it is in New Jersey.

Assuming the median US home value of $330k, a 4% increment in its value means adding around $13,000 to its value!

Others estimate the increase in value based on how much the solar system saves you per year, multiplying the annual savings by 20.

For example, with the example above where the solar system saves you around $100 per month, or $1,200 per year, the increase in home value would be:

$1,200 X 20 = $24,000 added to your home’s value by the system that costed around $10,000 to install!

Combine this with the benefits of free energy and tax credit, and you know that you have waited for so long.

Get a Free Quotation, Go Solar with $0 Down!

Get these benefits of solar tax credit, free energy, and increased home value, without paying anything in advance.

You can take the first step now by applying for a 100% quotation from SunPower through this link, or by clicking the image below.

Once you are on SunPower’s website, you will be asked to enter your area’s zip code, answer a question or two about your house and your electric bill, and you will be asked about your email.

SunPower will email you shortly to give you a FREE estimate about your expected savings, and they will then contact you to arrange for a FREE appointment in order to discuss the available financing options. No strings attached!

Remember that the solar tax credit will not last forever. Take advantage as soon as you can!